Droit Fiscal Américain

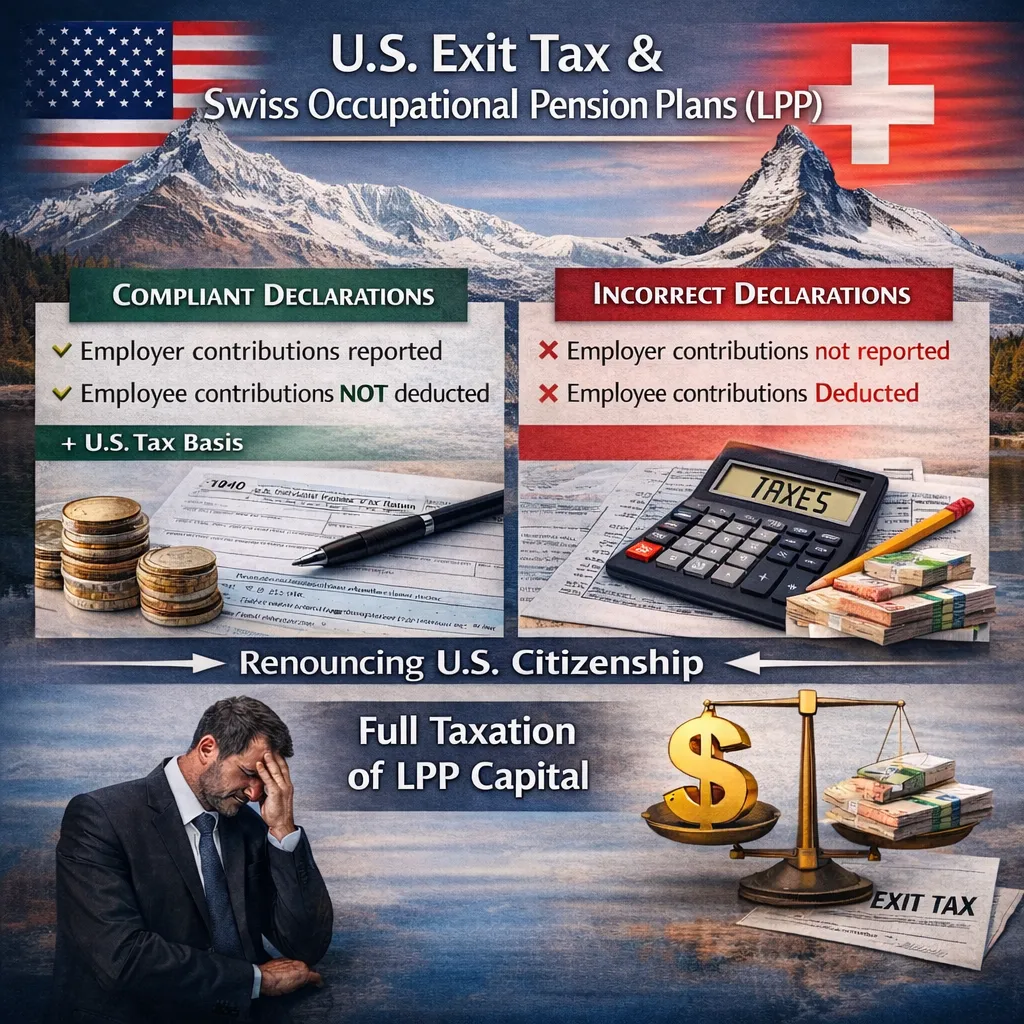

U.S. Exit Tax and Swiss Occupational Pension Plans (LPP)

Published on: 26/02/2026

Renouncing U.S. citizenship may trigger significant Exit Tax exposure, particularly on Swiss LPP pension capital. Understanding IRC §877A and Covered Expatriate rules is essential for international wealth planning.

US Tax

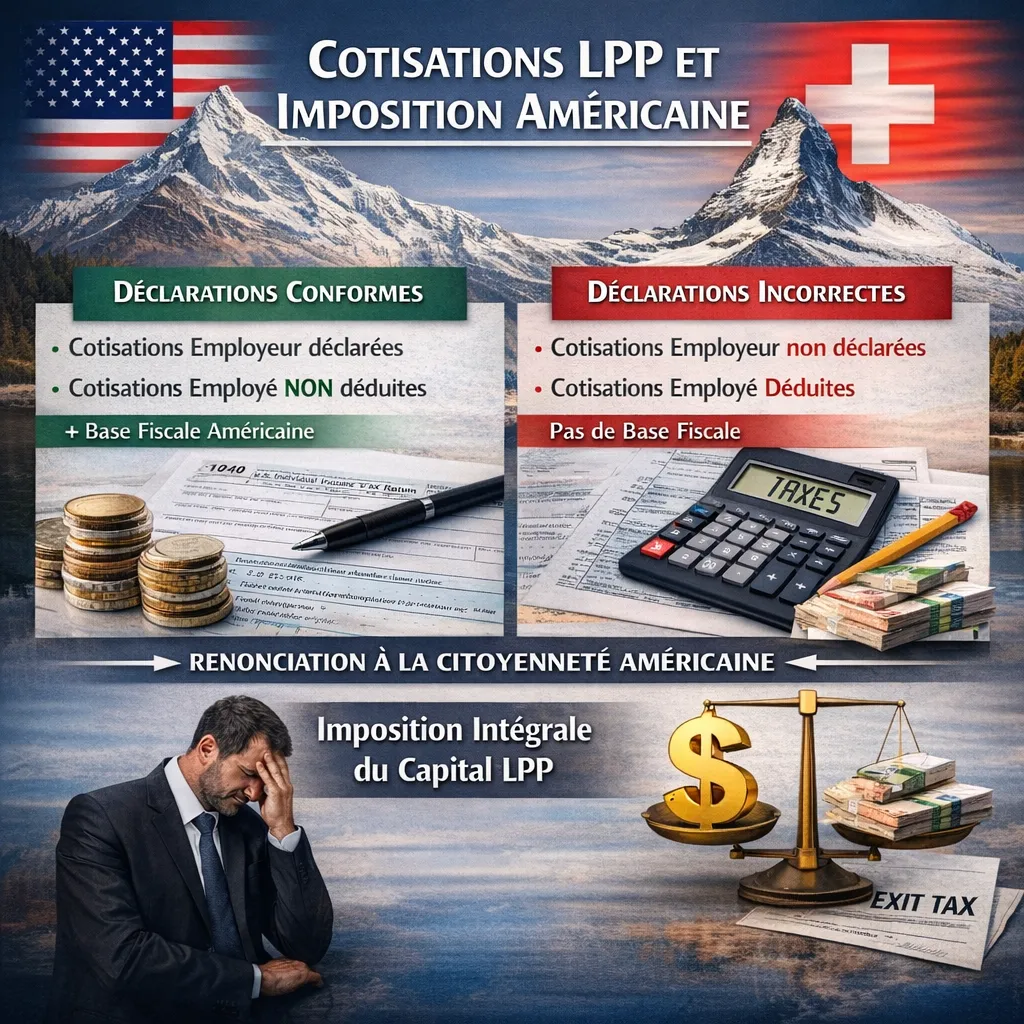

Exit Tax américaine et prévoyance professionnelle suisse (LPP)

Published on: 26/02/2026

Renoncer à la citoyenneté américaine peut entraîner une exit tax significative, notamment sur le capital LPP suisse. Analyse stratégique du traitement fiscal et des risques pour les clients internationaux.

US Tax (FR)

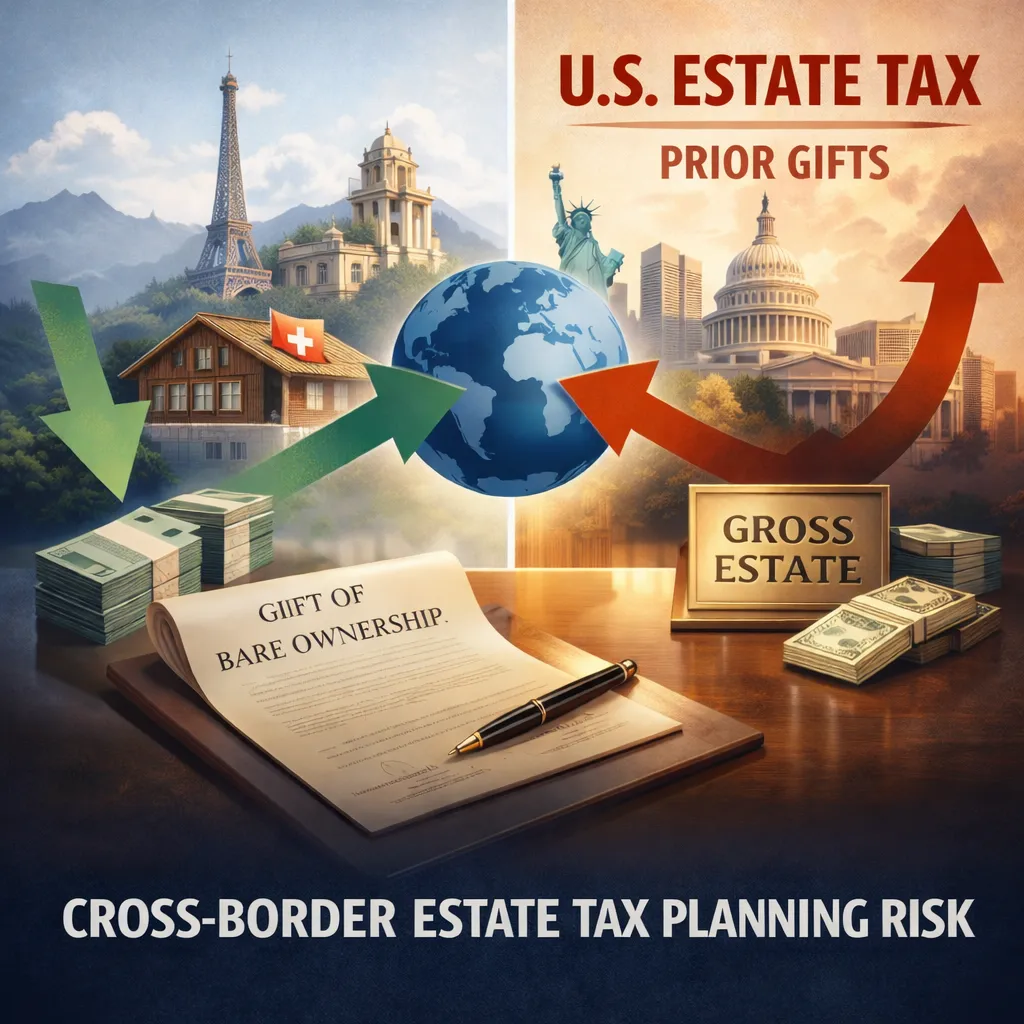

U.S. Estate Tax and Prior Gifts: A Critical Risk in International Estate Planning

Published on: 15/02/2026

How prior lifetime gifts can impact U.S. Estate Tax calculations and treaty credit planning for European investors and family offices.

US Tax

U.S. Estate Tax : donations antérieures et erreurs de planification successorale

Published on: 15/02/2026

U.S. Estate Tax et IRC §2036 : pourquoi une donation de nue-propriété peut être réintégrée dans la gross estate et fausser le crédit conventionnel.

US Tax (FR)